JNK India IPO: The company intends to raise Rs 650 crore through IPO. Under this IPO, fresh equity shares worth Rs 300 crore will be […]

Author: earn

Gold Prices Forecast: Gains Capped Amid Easing Middle East Tensions and Upcoming Economic Data

The trajectory of gold prices has experienced a noticeable shift in recent times, primarily due to diminishing geopolitical tensions in the Middle East and upcoming […]

Gold Prices Forecast: Gains Capped as Middle East Tensions Ease Gold prices fall due to reduced Middle East tensions PCE inflation data could delay anticipated Fed rate cuts Gold’s future prices influenced by geopolitical, economic data

Gold Prices Forecast: Gains Capped as Middle East Tensions Ease Gold prices fall due to reduced Middle East tensions PCE inflation data could delay anticipated […]

MCX is set to launch options contracts for both Crude Oil Mini and Natural Gas Mini!

MCX is set to launch options contracts for both Crude Oil Mini and Natural Gas Mini!

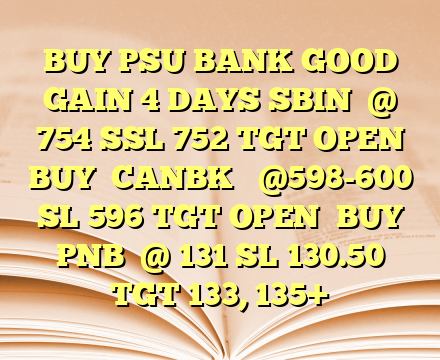

BUY PSU BANK GOOD GAIN 4 DAYS SBIN @ 754 SSL 752 TGT OPEN BUY CANBK @598-600 SL 596 TGT OPEN BUY PNB @ 131 SL 130.50 TGT 133, 135+

BUY PSU BANK GOOD GAIN 4 DAYS SBIN @ 754SSL 752TGT OPEN BUY CANBK @598-600SL 596TGT OPEN BUY PNB @ 131SL 130.50TGT 133, 135+

UBS Upgrades Voltas to “Buy”: Predicts Market Profit Boost from Voltbek JV

UBS has recently upgraded Voltas from a neutral to a buy rating, signaling strong confidence in the company’s future performance, particularly in the room air […]

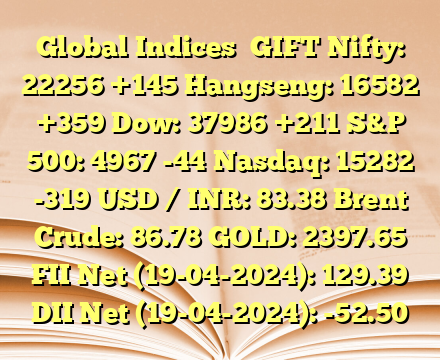

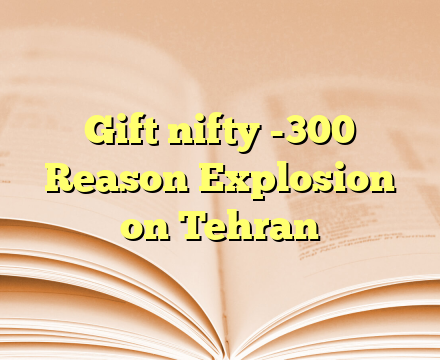

Global Indices GIFT Nifty: 22256 +145 Hangseng: 16582 +359 Dow: 37986 +211 S&P 500: 4967 -44 Nasdaq: 15282 -319 USD / INR: 83.38 Brent Crude: 86.78 GOLD: 2397.65 FII Net (19-04-2024): 129.39 DII Net (19-04-2024): -52.50

Global Indices GIFT Nifty: 22256 +145Hangseng: 16582 +359Dow: 37986 +211S&P 500: 4967 -44Nasdaq: 15282 -319USD / INR: 83.38Brent Crude: 86.78GOLD: 2397.65FII Net (19-04-2024): 129.39DII Net […]

Mutual Funds Show Confidence in Major Indian Companies Amid Market Optimism

In a recent shift in investment strategies, several prominent mutual funds have significantly increased their holdings in some of India’s leading corporations, indicating a bullish […]

U.S. stock index futures are on the rise in Sunday’s evening deals, signaling a hopeful recovery for Wall Street after two weeks of sharp declines driven by a tech sell-off and fading hopes for interest rate cuts. #WallStreet #StockMarket #FinanceNews

U.S. stock index futures are on the rise in Sunday's evening deals, signaling a hopeful recovery for Wall Street after two weeks of sharp declines […]

Options Trading in Simple Terms if I’m familiar with buying and selling stocks.

Options trading is a financial strategy that allows traders to buy or sell a specific stock at a predetermined price within a set period. Here’s […]

Assessing the Growth Prospects of Capacite Infra – Aiming for ₹330 and Beyond

Introduction Capacite Infrastructures Limited, a prominent construction company, is currently priced at ₹301 per share. This analysis explores the potential for this stock to surpass […]

MISTAKES -The Realities of Chasing Quick Wealth Through High Stakes

The Truths About Pursuing High-Stakes Gambling to Gain Quick WealthIt can be alluring to think that you could become wealthy over night. Extreme financial risks […]

HDFCBank Q4FY24 Good Results! Net Interest Income at ₹290.8 bn against ₹233.5 bn YoY, up 24.5% and ₹284.7 bn QoQ, up 2.61%. Net Profit stood at ₹16,511.85 Cr against ₹12,047.45 Cr YoY, up 37.05% and ₹16,372.54 Cr QoQ, up 0.85%. Total Deposits stood at ₹23,798 bn against ₹18,834 bn, up 26.4% YoY and 22,140 bn QoQ, up 7.5%. Provisions stood at ₹13,511.64 Cr against ₹2,685.37 Cr YoY, up 403.15% and ₹4,216.64 Cr QoQ, 220.4% CASA Ratio: 38.2% against 44% YoY and 38% QoQ. Net Interest Margin: 3.4% against 4.1% YoY and 3.4% QoQ. GNPA stood at 1.24% against 1.12% YoY and 1.26 QoQ. NNPA: 0.33% against 0.27% YoY and 0.31 QoQ. The Company proposed a dividend at ₹19.5 per share

HDFCBank Q4FY24 Good Results! Net Interest Income at ₹290.8 bn against ₹233.5 bn YoY, up 24.5% and ₹284.7 bn QoQ, up 2.61%. Net Profit stood […]

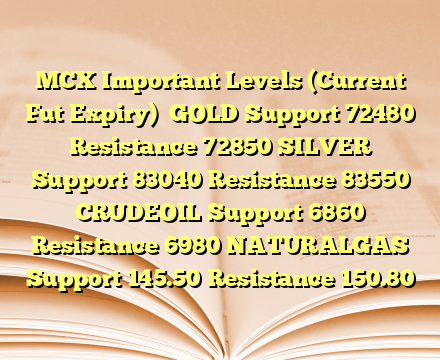

MCX Important Levels (Current Fut Expiry) GOLD Support 72480 Resistance 72850 SILVER Support 83040 Resistance 83550 CRUDEOIL Support 6860 Resistance 6980 NATURALGAS Support 145.50 Resistance 150.80

MCX Important Levels (Current Fut Expiry) GOLDSupport 72480 Resistance 72850SILVERSupport 83040 Resistance 83550CRUDEOILSupport 6860 Resistance 6980NATURALGASSupport 145.50 Resistance 150.80

ECB members on rate hikes A host of economists and monetary policymakers gathered in New York this week for the International Monetary Fund’s Spring Meetings — including numerous decision-makers from the European Central Bank. CNBC spoke to 12 members of the European Central Bank’s Governing Council, which votes on interest rate moves, in New York this week. There were two clear messages: expect a June cut, but beware of spillover effects from the Middle East

ECB members on rate hikes A host of economists and monetary policymakers gathered in New York this week for the International Monetary Fund’s Spring Meetings […]

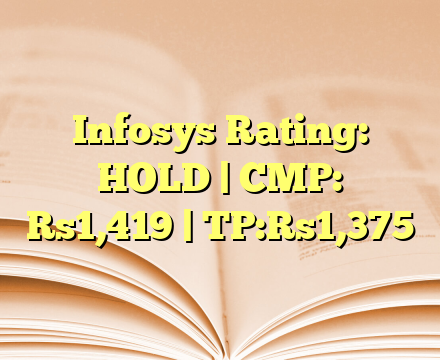

Infosys Rating: HOLD | CMP: Rs1,419 | TP:Rs1,375

Infosys Rating: HOLD | CMP: Rs1,419 | TP:Rs1,375

Israel launched a “limited” strike against Iran as a retaliation to the April 13 attack, Fox News reported, citing a source

Israel launched a "limited" strike against Iran as a retaliation to the April 13 attack, Fox News reported, citing a source

The UN security council will vote today on a draft resolution for admitting Palestine as a full member state of the United Nations – Axios

The UN security council will vote today on a draft resolution for admitting Palestine as a full member state of the United Nations – Axios