Morning Alert..

State govt bonds to yield better returns under new investment regime

The higher yield on state government bonds compared to central government securities is expected to make the former a “major draw” for banks for their investment book under the new portfolio norms, which kick in from April 2024. Treasury officials said while the central government paper would continue to have the largest share in the portfolio, the state government bonds would give the comfort of better returns to manage any pressures from adjustments in the months ahead. Under the new norms, banks must categorize bonds as “held-to-maturity” permanently, with the exception of 5 percent of the portfolio that can be withdrawn throughout the year. Any deviation from this rule requires approval from both the bank’s board and the Reserve Bank of India (RBI). Earlier, banks were allowed to reclassify their investments between categories once a year on the first day of the financial year, through which they used to book capital gains. “The character of demand for government bonds may go under change. Overall demand from banks, especially from public sector lenders, will not decline. The higher premium on state government paper will remain a draw for banks for their SLR book,” said the head of treasury with a large public sector bank (PSB).

Q3 GDP may slide to 6.7-6.9% on poor farm sector show: SBI Research

The Indian economy is likely to grow at 6.7-6.9 percent in the December quarter FY24 as compared to 7.6 percent growth in the second quarter on poor performance in the farm sector, a report by SBI Research said on Wednesday. The report comes a day ahead of the release of official GDP data for the third quarter of the 2023-24 financial year. India retained the tag of the world’s fastest-growing major economy, with its GDP expanding by a faster-than-expected rate of 7.6 percent in the September quarter on booster shots from government spending and manufacturing. The 6.7-6.9 percent growth forecast by SBI Research is lower than the Reserve Bank’s 7 percent growth projection for the quarter. SBI Research has projected Q4 GDP at 6.8 percent. SBI Research said the biggest reason for the lower growth forecast is the very poor show by the farm sector as, barring fisheries, the whole sector is badly affected.

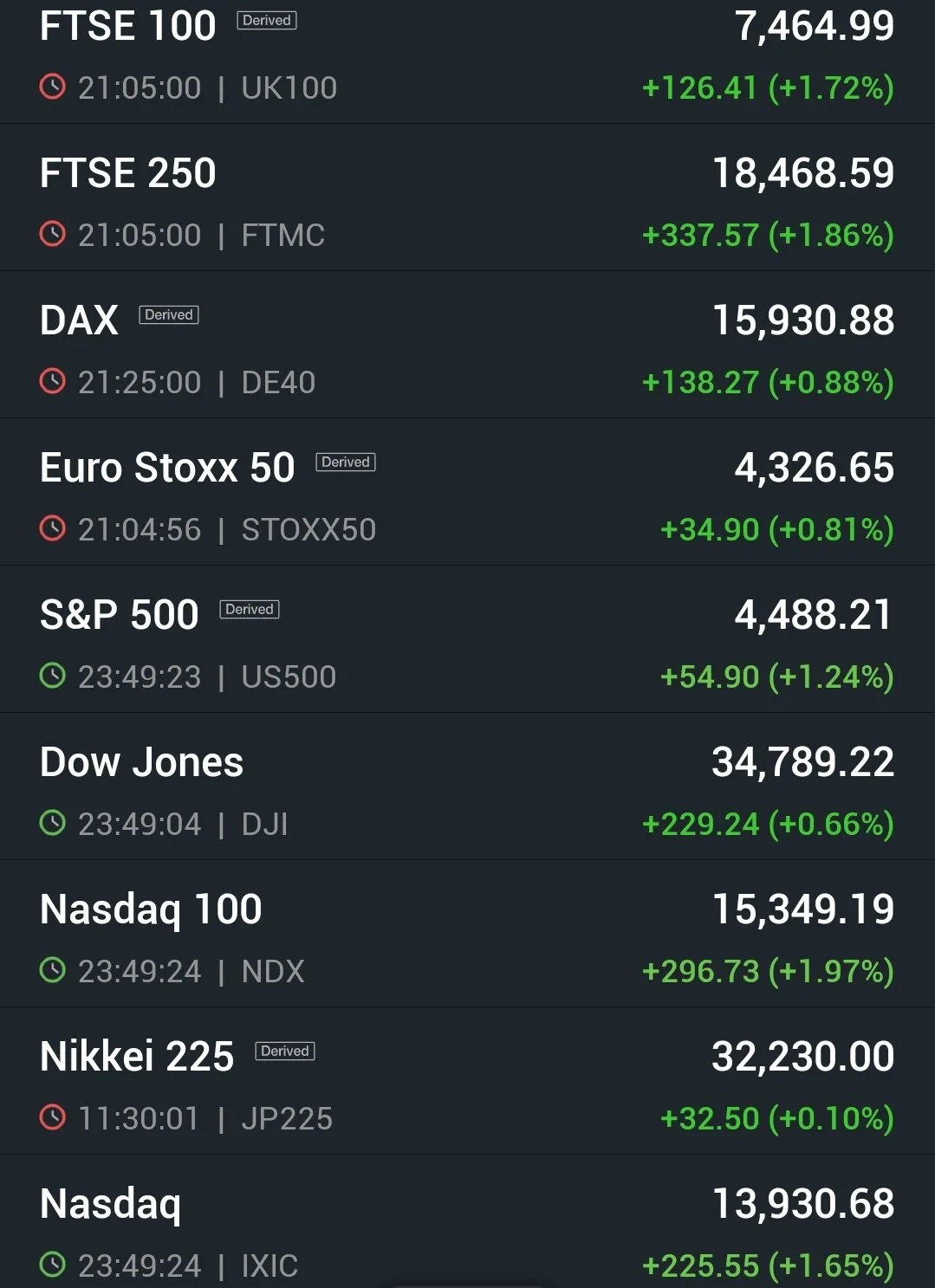

Global market action

Dow Jones – Down by 0.09% or 34.04 points

FTSE – Down by 0.76% or 58.04 points

CAC – Up by 0.08% or 5.99 points

DAX – Up by 0.25% or 44.73 points

Gift Nifty – Up by 0.24% or 52.50 points

FII/DII activities

FII – Sold 1879.23 Cr worth of shares

DII – Bought 1827.45 Cr worth of shares.

Primary market activities

Garware Technical Fibres – 91.7%

Carborundum Universal – 90.5%

EIH Ltd – 90.3%

Zydus Wellness – 90.1%

Metro Brands – 88.7%

Primary market updates

IPO opening today

Mukka Proteins Ltd (Main Board) – Issue size 224Cr

Listing today

GPT Healthcare Ltd (Main Board) – Subscribed 8.52x

Commodities updates

Gold – Rs 63860/10gm, Silver – Rs 69949/kg, Brcrude – Rs 6465/barrel, Copper – Rs 724/kg.

Corporate News

Reliance, Disney form joint venture to merge TV, OTT business in India.

Gensol says it has approval for its flagship two-seater electric car.

SpiceJet settles $30 mn dispute with Celestial Aviation outside tribunal.