Crude Oil Price to Rise Today from Support

Crude oil prices are expected to rise today, October 4, 2023, after finding support at the $94 level. The market is being supported by a number of factors, including:

- Strong demand: Global demand for crude oil is expected to remain strong in the coming months, as economies recover from the COVID-19 pandemic.

- Limited supply: The supply of crude oil is limited due to factors such as the ongoing conflict in Ukraine and sanctions on Russia.

- Weakening US dollar: A weaker US dollar makes oil more affordable for buyers who use other currencies.

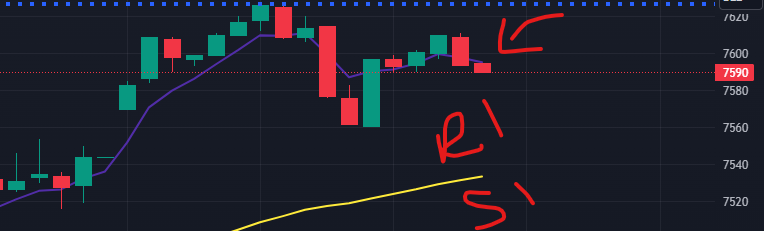

Technical analysts also point to the fact that crude oil prices have found support at the $94 level. This could indicate that the market is ready to resume its upward trend.

Factors to watch

There are a number of factors that could impact crude oil prices in the coming days, including:

- OPEC+ meeting: OPEC+ is scheduled to meet on October 5 to discuss production policy. If the group decides to cut production, it could lead to a further increase in oil prices.

- US economic data: Investors will be closely watching US economic data this week, including the non-farm payrolls report on Friday. Strong economic data could lead to a rise in oil prices, as it would indicate that demand for the commodity is likely to remain strong.

- Geopolitical tensions: The ongoing conflict in Ukraine and other geopolitical tensions could also impact oil prices. If these tensions escalate, it could lead to a risk premium being priced into oil prices.

Conclusion

Overall, the outlook for crude oil prices is positive in the short term. The market is being supported by strong demand, limited supply, and a weaker US dollar. Technical analysts also point to the fact that crude oil prices have found support at the $94 level. However, investors should be aware of the potential for volatility, as oil prices can be impacted by a number of factors, including OPEC+ policy, US economic data, and geopolitical tensions.