Foreign Institutional Investors (FIIs) are showing robust confidence in the market, with net long positions now standing at 52%. This positive sentiment is mirrored in the outlook for India’s major indices, NIFTY and BANKNIFTY, which are both poised for significant upward movements in the near term.

NIFTY’s Bullish Trajectory

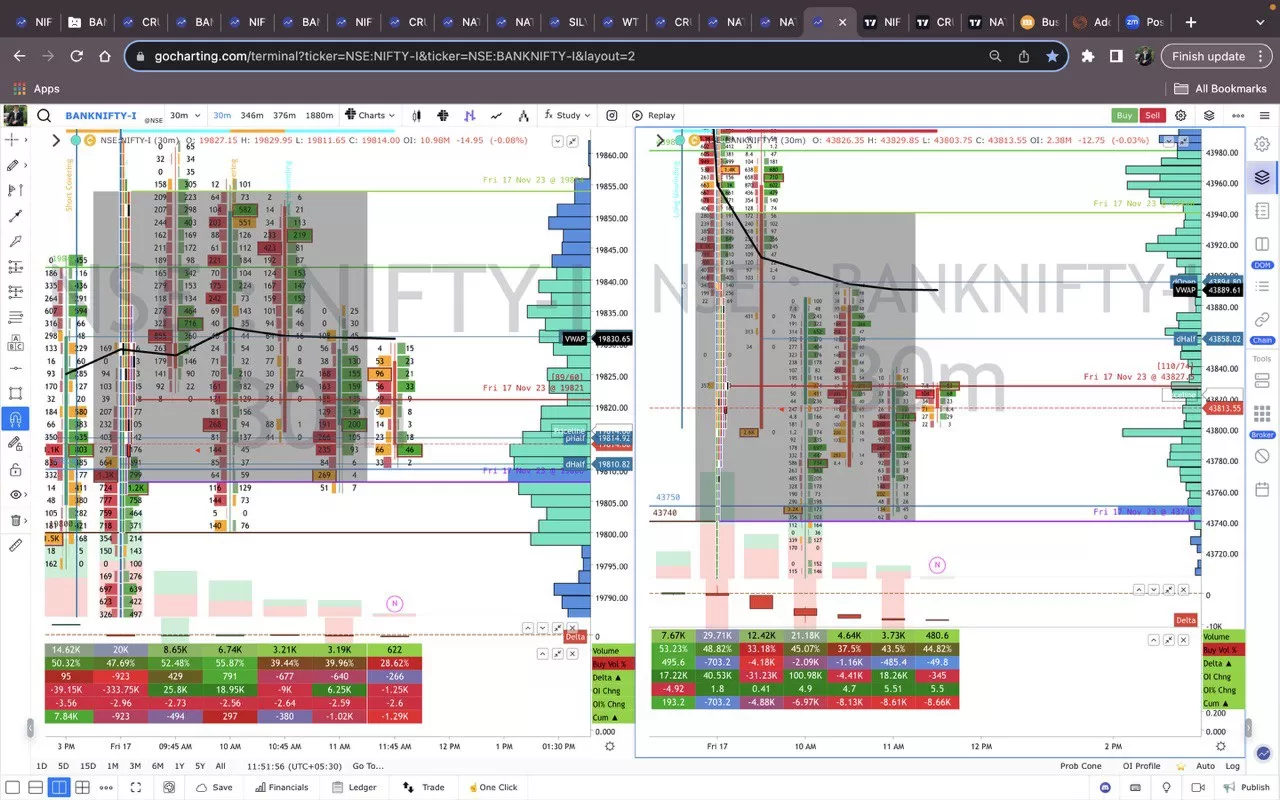

NIFTY is currently on a bullish trajectory, with market analysts predicting that it could soon test the 23,000 mark. This optimism is driven by a steady buying trend on every decline, particularly around the 22,500 level, suggesting strong support and a bullish sentiment among investors. This strategy of buying on dips not only reflects a positive market sentiment but also positions NIFTY for potential gains, making it an attractive option for positional players looking to capitalize on these movements.

BANKNIFTY’s Progressive Outlook

Similarly, BANKNIFTY is showing a strong upward trend with projections moving towards the 51,000 zones. The index has substantial support at the 49,000 levels, which should hold in the face of any short-term volatility. This support level acts as a critical junction for investors, as maintaining above this threshold could further fuel the bullish outlook and drive momentum in the banking sector.

Investment Strategies

Investors are advised to consider a strategy of buying on dips within these specified ranges to leverage potential upward swings. Given the current market conditions and the bullish sentiment supported by FIIs, both indices offer promising growth opportunities.

#FIIs #BullishMarket #NIFTY23000 #BANKNIFTY51000 #SupportLevels #BuyingOnDeclines #PositionalPlay #MarketMomentum #InvestmentStrategy #FinancialMarkets #StockMarket #EquityInvesting #MarketOutlook #InvestingTips

Conclusion

The current market outlook for NIFTY and BANKNIFTY is decidedly bullish, with strong support levels and a strategy of buying on declines indicating a potential for significant gains. Investors looking to take advantage of this momentum should focus on these indices as key areas for investment, aligning their strategies with the ongoing trends to maximize returns. The sentiment driven by the FIIs’ bullish positions further reinforces the potential for a sustained upward trajectory in the coming sessions.