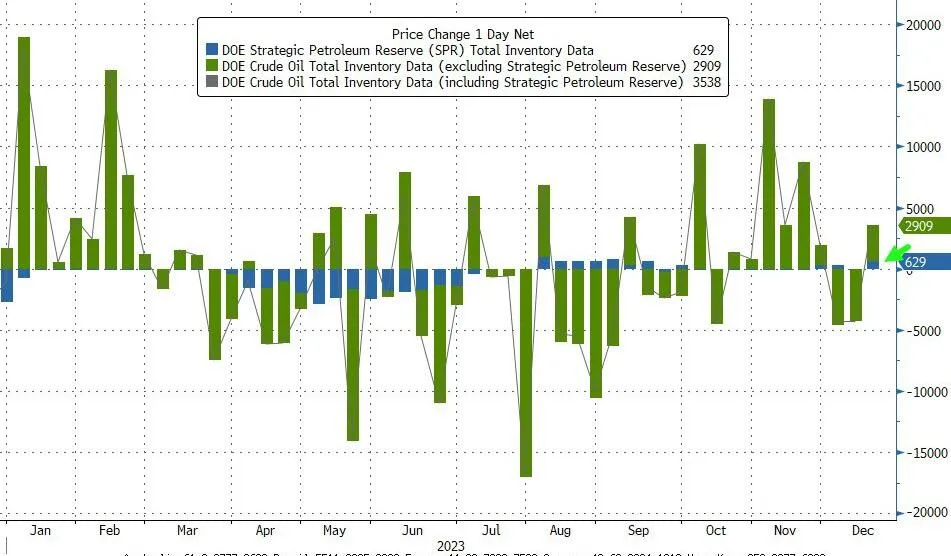

In a recent move, the Biden administration has taken steps to strengthen the country’s energy security by adding 629,000 barrels to the Strategic Petroleum Reserve (SPR). This strategic decision comes at a time of increased global uncertainty and reflects efforts to ensure a stable and resilient energy supply for the United States.

Simultaneously, the latest data reveals that US crude production has surged by 200,000 barrels per day, reaching a new record high. This notable increase underscores the nation’s continued role as a significant player in the global oil market.

Strategic Petroleum Reserve Reinforcement:

The decision to bolster the SPR is a proactive measure to enhance the nation’s ability to respond to potential disruptions in oil supply. The SPR serves as a crucial buffer, allowing the US to mitigate the impact of unforeseen events on energy markets and maintain stability in the face of geopolitical and economic challenges.

This move aligns with the Biden administration’s broader strategy to address concerns about energy security and maintain a resilient energy infrastructure. The addition of barrels to the SPR signals a commitment to safeguarding the nation’s interests in a dynamic global energy landscape.

Record High in US Crude Production:

Concurrently, the surge in US crude production to a new record high highlights the nation’s robust energy sector. The increase of 200,000 barrels per day demonstrates the resilience and efficiency of the domestic oil industry, contributing to the nation’s energy independence.

The record-setting production figures also have implications for global oil markets, as the United States continues to play a pivotal role in shaping supply dynamics. The surge in crude production reflects the ongoing advancements in technology and extraction methods that have propelled the country to the forefront of the global energy stage.

Implications and Outlook:

The Biden administration’s decision to reinforce the Strategic Petroleum Reserve and the concurrent achievement of record-high crude production underscore the multifaceted nature of the United States’ energy strategy. As the nation navigates the complex landscape of energy security and production dynamics, these developments will likely be closely monitored for their impact on domestic and global energy markets.

In the face of evolving geopolitical and economic challenges, the ability of the United States to adapt and respond strategically to changes in the energy landscape remains critical. The recent actions by the Biden administration reflect a commitment to balancing energy security, economic considerations, and global market dynamics in the pursuit of a resilient and sustainable energy future.