Market Outlook

The recent trading session in the Indian stock market unfolded with a mix of dynamics, showcasing both resilience and volatility across various indices and sectors. Let’s delve into a comprehensive analysis of the day’s events and their implications for market participants.

Nifty’s Performance:

The Nifty index started on a relatively flat note but swiftly gained momentum, experiencing a surge in buying activity during the initial hours of trading. Despite maintaining a narrow range between 22080 and 22200 for the remainder of the day, the index managed to close higher, recording a commendable gain of 0.70 percent.

Midcap Outperformance:

In contrast to the Nifty 50, the Nifty Midcap 100 index stole the spotlight by exhibiting robust performance, closing the session with a substantial gain of 2.15 percent. This surge in midcap stocks signals a broader bullish sentiment in the market.

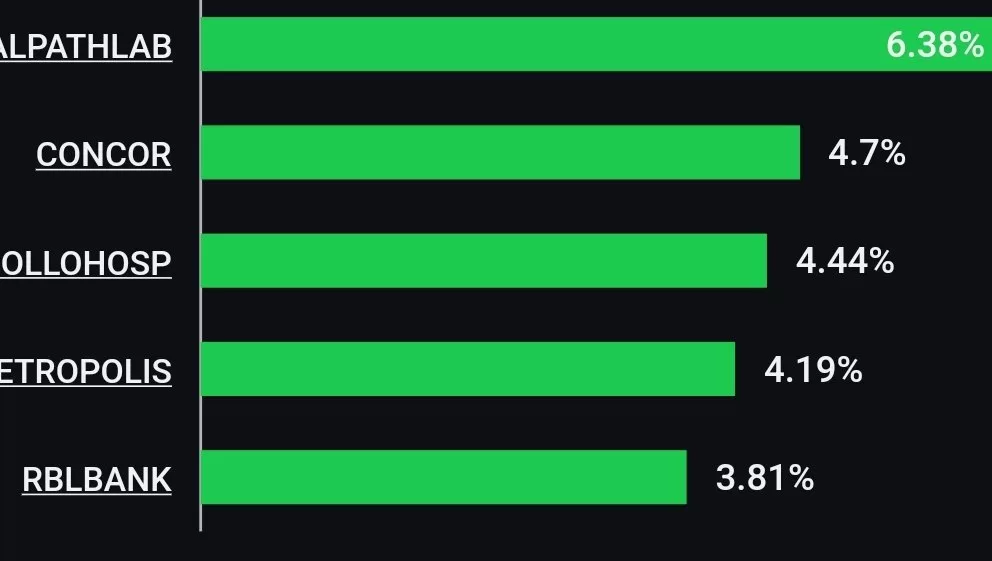

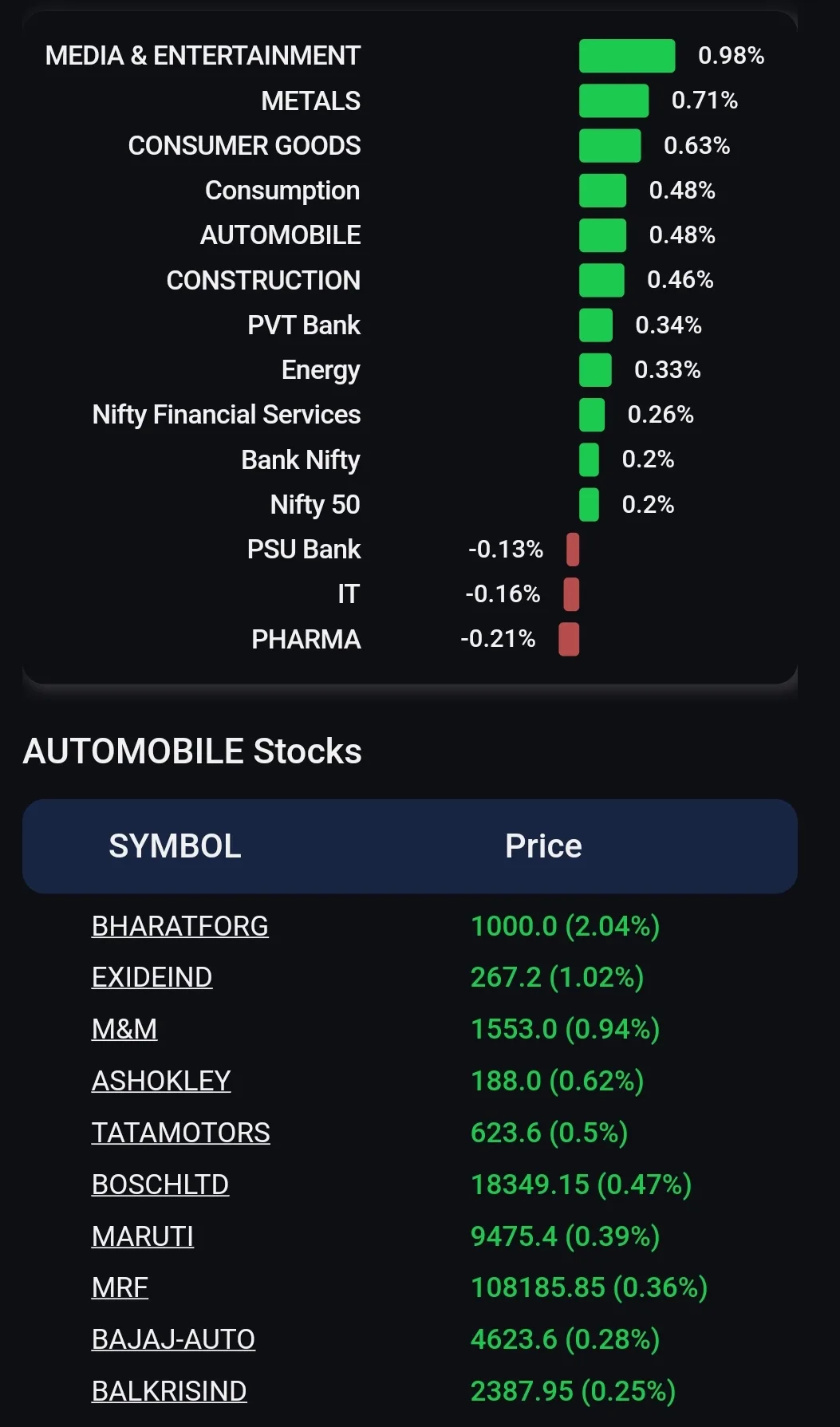

Sectoral Performance:

Energy and Metals sectors emerged as top performers, showcasing strength amidst the trading session. On the flip side, Banking and Financial Services sectors faced challenges, displaying weaker performance and lagging behind other sectors.

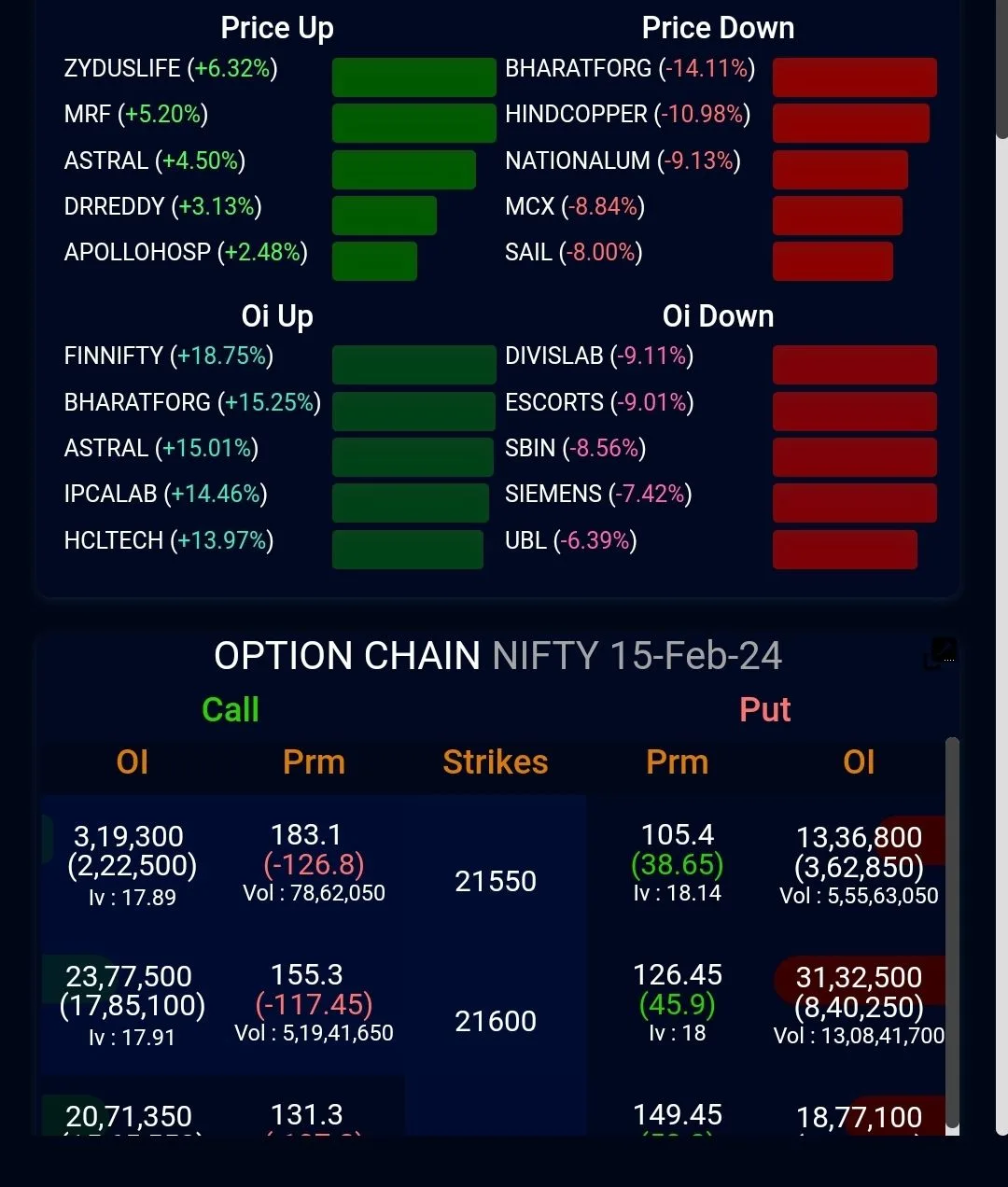

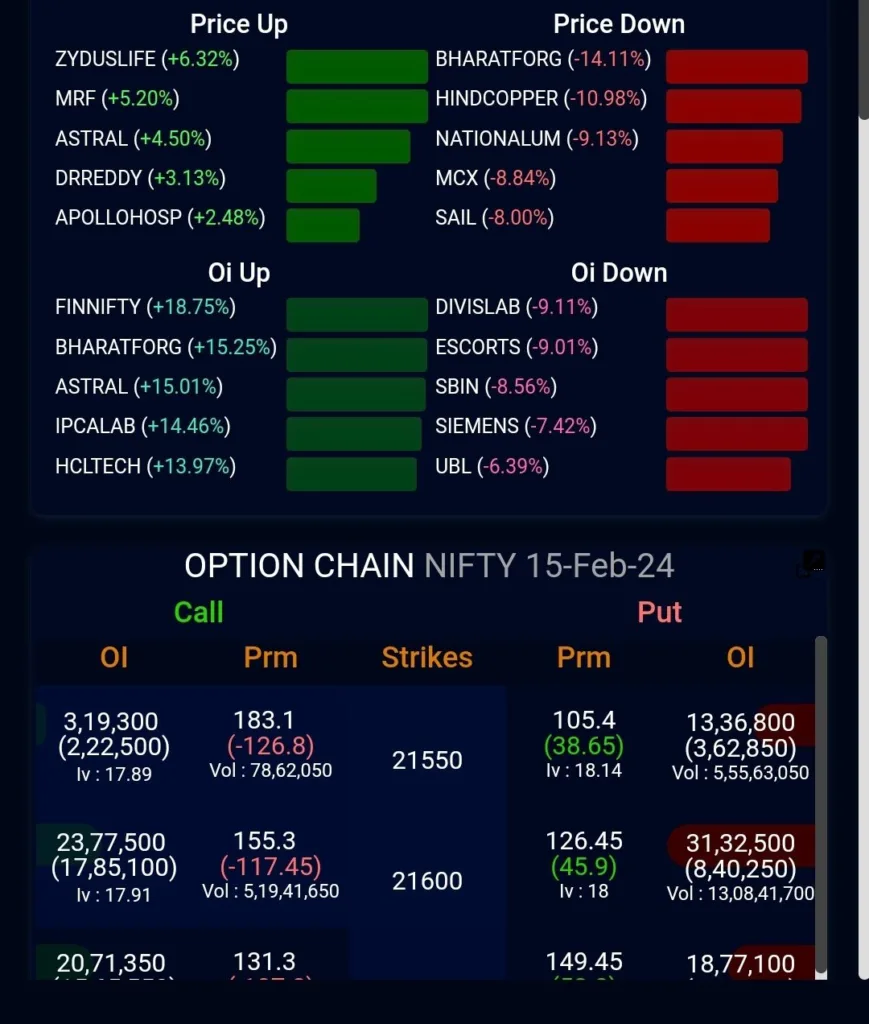

Options Market Insights:

Analyzing the options market reveals valuable insights. The highest open interest on the call side at the 22500 level and on the put side at 22000 suggests a balanced outlook. Today’s option chain indicates balanced writing on both call and put sides, indicating a range-bound activity in the near term.

Market Indicators for Next Session:

Volume Weighted Average Price (VWAP) suggests a trading range for the next day between 21975 and 22360. Additionally, the Max Pain observed at the 22200 spot, along with the CE/PE Combined Residual Premium/Pain Value of 172.92 Crores, provides further guidance for market expectations.

Institutional Activity:

Foreign Institutional Investors (FIIs) were net sellers with an activity totaling 1356.29 crore in the cash market. In contrast, Domestic Institutional Investors (DIIs) exhibited net buying activity of 139.47 crore, showcasing a mixed sentiment among institutional investors.

In conclusion, the day’s trading session witnessed a blend of positive momentum and sectoral divergence. While the Nifty index closed higher, driven by midcap outperformance and strength in select sectors, challenges persist in others. Market participants are advised to closely monitor key levels and indicators for informed decision-making in the upcoming sessions.