Top Finance News

:Mid-2025 Market Movers & Shakers

Focus Keywords: Stock Market, Global Economy, Inflation, Interest Rates, Tech Sector, Emerging Markets, Financial News, Investment Trends, Mid-2025 Outlook

As we navigate through the middle of 2025, the global financial landscape continues to present a dynamic mix of opportunities and challenges. Here’s a rundown of the top finance news stories that are currently shaping investor sentiment and market directions.

- Inflationary Pressures Persist, Central Banks Remain Vigilant

While there have been some signs of easing in certain regions, inflation remains a persistent concern across major economies. Central banks, including the US Federal Reserve, the European Central Bank, and the Reserve Bank of India, are largely maintaining a cautious stance. Recent statements suggest that while further aggressive rate hikes might be off the table for now, any significant rate cuts are also not imminent. The focus remains on bringing inflation firmly within target ranges without stifling economic growth. This “higher for longer” interest rate environment continues to influence borrowing costs and corporate earnings. - Tech Sector’s Resurgence: AI Continues to Drive Enthusiasm

The technology sector continues to be a dominant force in the markets. The excitement surrounding Artificial Intelligence (AI) shows no signs of waning, with significant investments and advancements being announced almost daily. Large-cap tech giants are leveraging AI to boost efficiency and create new revenue streams, leading to strong stock performance for many players in the space. However, analysts are also increasingly scrutinizing valuations, prompting discussions around sustainable growth and potential regulatory oversight in the burgeoning AI landscape. - Emerging Markets: Navigating Volatility with Growth Potential

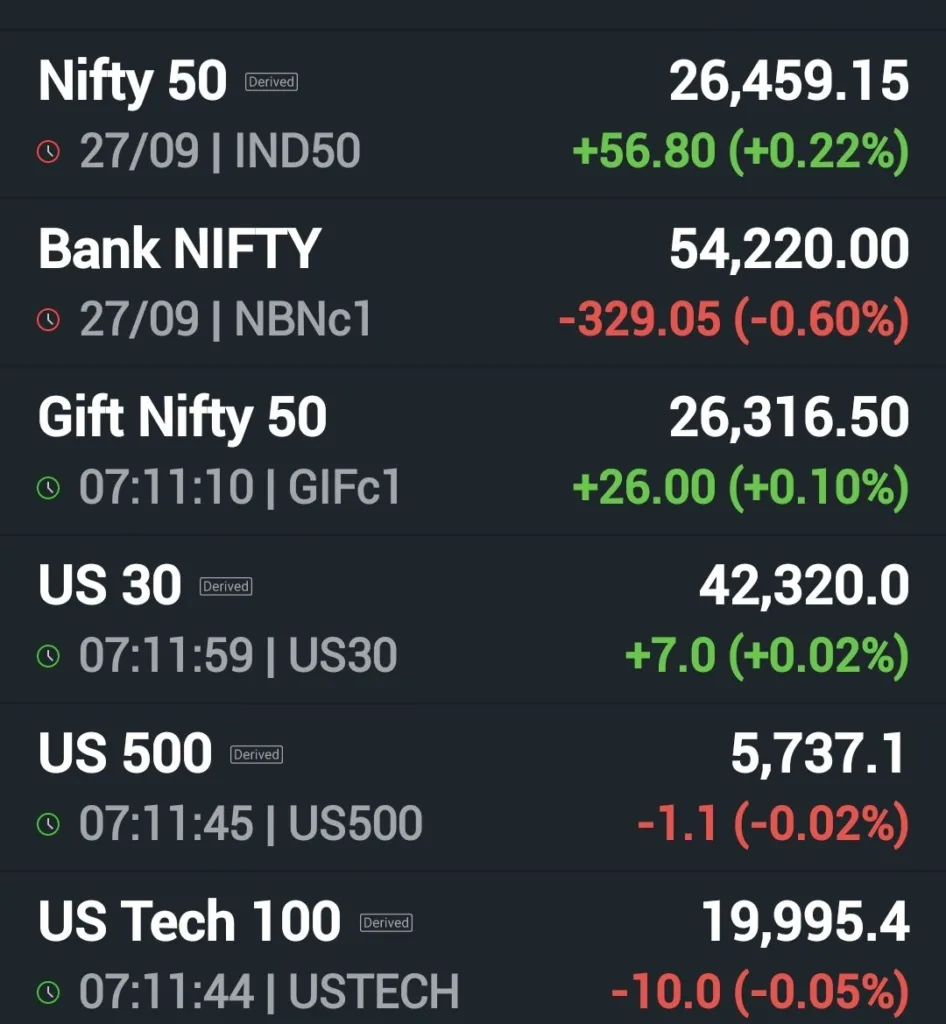

Emerging markets are presenting a mixed bag. While some economies are showing robust growth driven by domestic demand and favorable commodity prices, others are grappling with currency fluctuations, geopolitical tensions, and external debt concerns. India, for instance, continues to be a bright spot, attracting significant foreign investment due to its strong economic fundamentals and demographic dividend. Investors are increasingly discerning, focusing on countries with sound fiscal policies and structural reforms. - Geopolitical Tensions & Supply Chain Resilience

Ongoing geopolitical tensions in various parts of the world continue to cast a shadow over global trade and supply chains. Businesses are increasingly prioritizing resilience and diversification in their supply networks to mitigate risks. This trend is leading to strategic shifts in manufacturing locations and sourcing strategies, impacting global trade flows and investment patterns. - Corporate Earnings: A Mixed Bag Amidst Economic Uncertainty

The latest round of corporate earnings reports has painted a somewhat mixed picture. While some sectors, particularly those benefiting from digital transformation and consumer spending, have reported strong results, others are feeling the pinch of higher input costs and softening demand. Companies that have successfully managed to pass on costs to consumers or improve operational efficiencies are generally outperforming. Investors are closely watching forward guidance for insights into future profitability.

Looking Ahead:

The remainder of 2025 is expected to be characterized by continued vigilance regarding inflation and interest rate trajectories. The tech sector, particularly AI, will likely remain a key driver, while investors will need to carefully navigate opportunities and risks in emerging markets. Geopolitical developments will also remain a critical factor influencing market sentiment and investment decisions. Staying informed and agile will be key for investors looking to thrive in this evolving financial landscape.

Comments are closed.