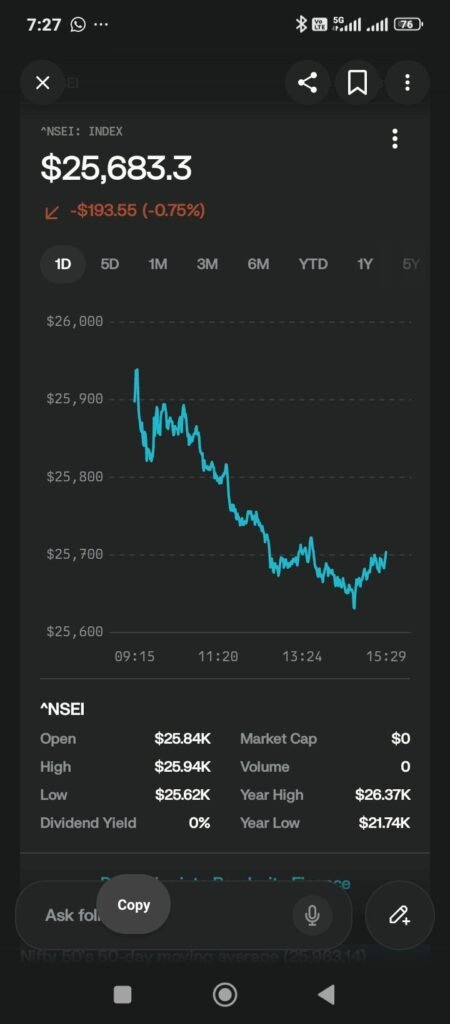

Nifty Technical Outlook

Nifty 25963.14 vs 25051.91

Nifty 50’s 50-day moving average (25,963.14) exceeds the 200-day moving average (25,051.91) by 911.23 points, confirming a bullish “golden cross” alignment.[1][2]

Key Comparison

Metric Value Status vs Price (25,683.30) 50-day MA 25,963.14 Above (resistance) 200-day MA 25,051.91 Below (support) Difference +911.23 Bullish medium-term trend [1][2]

Implications

Price sits between both MAs, with 50-day MA as near-term resistance and 200-day MA as stronger long-term support; a break above 25,963 could signal renewed uptrend.[1][2]

Citations:

[1] NIFTY 50 Stock Price: Quote, Forecast, Splits & News (^NSEI) https://www.perplexity.ai/finance/%5ENSEI

[2] NIFTY 50 daily Technical Analysis | Stochastic RSI indicators https://www.moneycontrol.com/technical-analysis/indian-indices/nifty-50-9/daily

[3] NIFTY 50 Daily Technical Analysis | Stochastic RSI indicators https://www.moneycontrol.com/technical-analysis/indian-indices/nifty-50-9

[4] Indices Moving Averages https://in.investing.com/technical/indices-moving-averages

[5] Nifty 50 Technical Analysis and Moving Averages – Investing.com https://www.investing.com/indices/s-p-cnx-nifty-technical

[6] Technical Analysis of Nifty 50 Index (NSE:NIFTY) https://in.tradingview.com/symbols/NSE-NIFTY/technicals/

[7] DMA 200 > Current Price (Nifty 50) – Screener https://www.screener.in/screens/495053/dma-200-current-price-nifty-50/?order=asc

[8] How to Trade 200 SMA | How to Trade 50 & 100 Day Moving Average https://enrichmoney.in/knowledge-center-chapter/how-to-trade-200-period-moving-average

[9] Nifty 50 EMA 50, EMA 200 cross over, Technical Analysis Scanner https://chartink.com/screener/nifty-50-ema-50-ema-200-cross-over

[10] Technical Analysis of Nifty 50 Index (NSE:NIFTY) – TradingView https://www.tradingview.com/symbols/NSE-NIFTY/technicals/

Comments are closed.