In a shocking turn of events, the financial markets have experienced their most significant decline in two years, leaving investors on edge. Both the Sensex and Nifty indices recorded a 2% drop, while Nifty banks faced an even steeper plunge of over 4%, marking their most substantial fall since February 2022. In this blog post, we’ll delve into the reasons behind this unprecedented market downturn and the profound impact it has had on the market capitalization of BSE-listed companies, erasing a staggering ₹4 Lakh Crore in a single day.

Understanding the Market Meltdown:

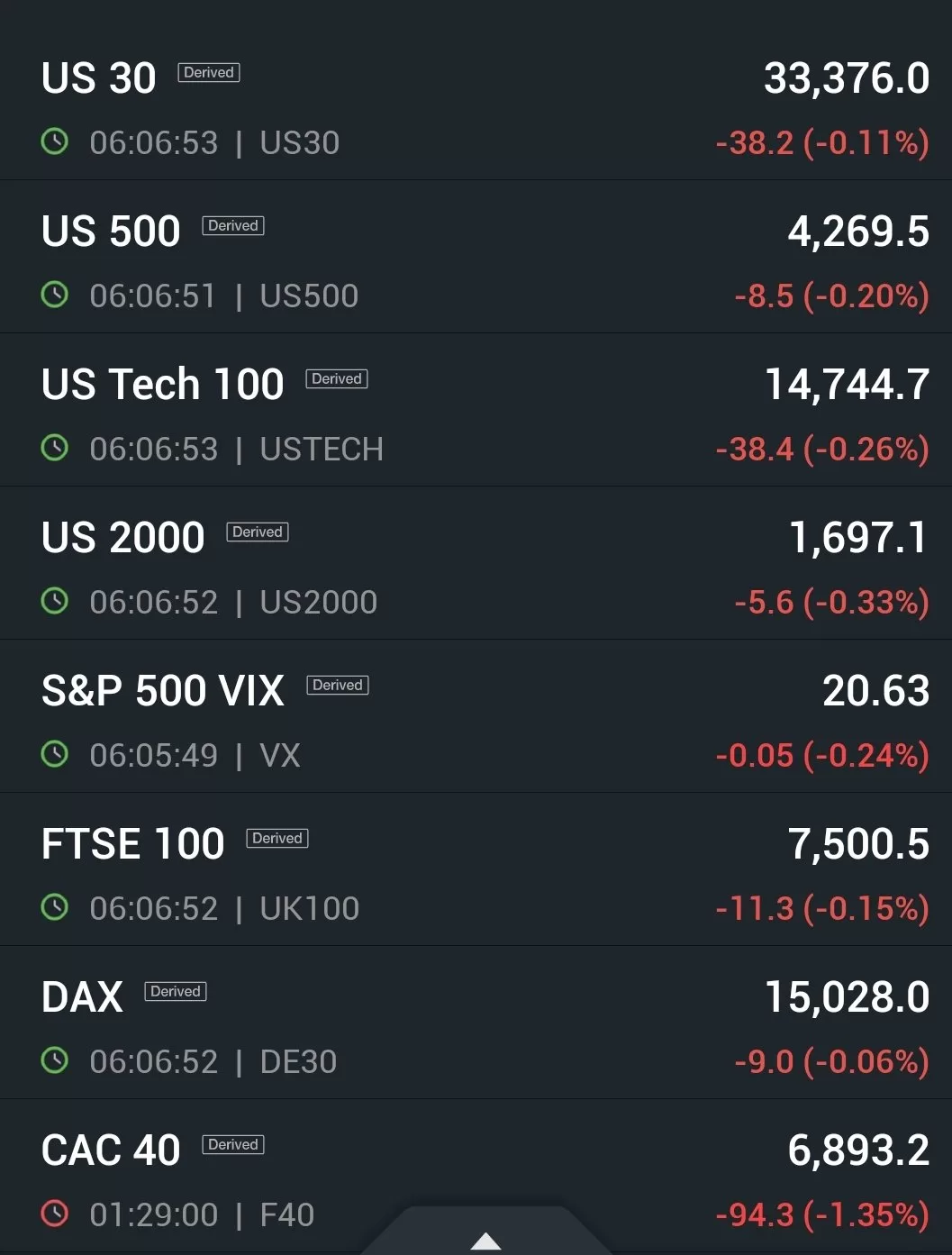

The recent market slump has sent shockwaves through the investment community, raising concerns about the stability of financial markets. Global economic uncertainties, coupled with escalating geopolitical tensions, have played a pivotal role in triggering this substantial downturn. Investors are grappling with the aftermath of this plunge, prompting a thorough examination of market dynamics.

Key Highlights of the Market Fallout:

- Sensex and Nifty’s 2% Decline: The flagship indices, Sensex and Nifty, both experienced a 2% dip, reflecting the widespread negative sentiment in the market.

- Nifty Banks’ 4% Plunge: Nifty banks bore the brunt of the downturn, recording a more than 4% decline, marking their most significant fall since February 2022.

- ₹4 Lakh Crore Market Cap Erosion: BSE-listed companies collectively witnessed a staggering ₹4 Lakh Crore erosion in market capitalization, underscoring the severity of the market correction.

Analyzing Factors Behind the Market Turmoil:

Several factors have contributed to this abrupt market downturn, including global economic uncertainties, geopolitical tensions, and concerns about inflation. Understanding these contributing factors is crucial for investors seeking to navigate through the aftermath and make informed decisions.

Implications for Investors and Companies:

Investors are now confronted with the challenge of reassessing their portfolios and risk management strategies in the wake of this unprecedented market movement. Additionally, BSE-listed companies must strategize to regain lost market value and instill confidence among stakeholders.

The recent market plunge, with its profound impact on key indices and market capitalization, serves as a stark reminder of the inherent volatility in financial markets. As investors and companies alike grapple with the aftermath, a prudent and informed approach is crucial. Navigating through these uncertain times requires a comprehensive understanding of market dynamics, a reassessment of investment strategies, and a vigilant eye on global economic trends. In the face of adversity, resilience and strategic decision-making will be paramount for both investors and market participants.