Market Pulse

Dalal Street Takes a Breather

Thursday, January 15, 2026

If you logged into your trading terminal today and saw a sea of stillness, don’t worry—your app isn’t broken. Indian equity markets (NSE and BSE) are closed today, January 15, on account of the Municipal Corporation Elections in Maharashtra.

While the floors are quiet today, the action leading up to this break has been anything but boring. Here is the “Rock Post” summary of where we stand.

📉 The Pre-Holiday Wrap (Jan 14)

The markets headed into the holiday on a cautious note yesterday. Benchmark indices faced a bit of gravity as geopolitical jitters and trade uncertainties kept bulls in check.

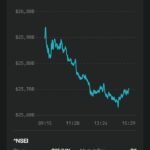

- Nifty 50: Settled at 25,665, down about 67 points.

- Sensex: Dropped 245 points to close at 83,382.

- The Vibe: It was a “Red Day” for the heavyweights, but the broader market showed some grit.

🔥 Sectoral Heatmap: Metals Shine, IT Falters

Even in a down market, money always finds a home. Here’s who won and who lost yesterday: - 🤘 Metals on Fire: The Nifty Metal index was the rockstar, rallying 2.7%. Global demand and a slight cooling of the US Dollar have traders betting big on commodities. Vedanta (+6%) and Tata Steel (+3.7%) led the charge.

- 💻 IT Cooling Off: The tech pack took a hit, with the Nifty IT index falling over 1%. Profit booking in TCS and Tata Elxsi dragged the sector down.

- 🏦 Banking Resilience: While the main indices fell, Bank Nifty managed to stay afloat, showing that the backbone of the economy is still holding firm.

🚀 Stocks in the Spotlight

Keep these on your radar for when the gates open on Friday: - Tata Steel & NTPC: These were the top gainers yesterday and are showing strong momentum.

- ICICI Lombard: Reported a slight dip in Q3 net profit (~₹659 Cr); watch for the market’s reaction to their earnings quality.

- Tata Elxsi: Despite a 30% YoY growth in profit, the stock faced heavy selling pressure. Is it a “buy on dip” opportunity?

📅 What’s Next? (The Friday Reopen)

When trading resumes tomorrow, January 16, all eyes will be on: - The $25,600 Support: If Nifty breaks below this, we might see a slide toward 25,450.

- Maharashtra Election Sentiment: Local political stability often plays a silent but significant role in investor confidence.

- Global Cues: Watch the US markets tonight; any major swing there will dictate our gap-up or gap-down opening tomorrow.

Investor Note: With the market closed today, it’s a great time to review your portfolio and check if your stop-losses are in place. 2026 is shaping up to be a “Year of Earnings,” where stock selection will beat general market tracking.

Would you like me to analyze a specific stock’s technical chart for you, or perhaps help you draft a strategy for the Friday reopen?

Comments are closed.