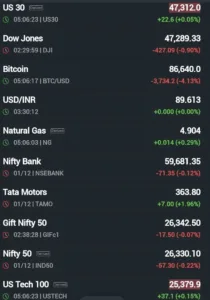

Global Markets Today: Dow Slips, Bitcoin Weakens,

Global snapshotUS30 (Dow Jones) is trading slightly below recent highs after a modest decline, signaling fatigue near the 47,500 region even as the broader uptrend remains intact.�� Bitcoin, meanwhile, is consolidating after a sharp run, with INR‑quoted prices easing as global crypto liquidity cools off and traders lock in profits near multi‑month highs.�� Together, these moves point to a “risk‑off lite” mood rather than a full‑blown reversal, which usually translates into choppy but tradable conditions for Indian indices.��Indian market setupThe Nifty 50 cash index closed near the 26,175 mark in the previous session, slipping marginally but still holding above key short‑term support zones seen near 26,000–26,050.�� Gift Nifty and related futures quotes are indicating a flat to slightly negative open, in line with the soft cues from US equities and sideways Asian risk sentiment.�� For intraday traders, the immediate structure favors buy‑on‑dip strategies above support, with resistance now layered closer to the recent high around 26,300 where sellers repeatedly emerged.��US indices and macro toneWall Street’s Dow‑linked benchmarks have cooled after an impressive 12‑month climb, with the latest session showing a fractional decline of around 0.3% as investors reassess earnings and rate‑cut expectations.�� Futures data and index commentary suggest that while momentum has slowed, breadth remains reasonably healthy, with dips still being used to add exposure to large‑cap industrials and tech.�� For Indian traders, this backdrop generally supports sector‑specific trades in banks and IT rather than aggressive index chasing at all‑time highs.��Bitcoin, USDINR and cross‑asset cuesIn crypto, live BTC‑INR converters place one Bitcoin in the ₹80–82 lakh zone, showing minor day‑on‑day losses but holding well above the ₹75 lakh breakout area that triggered the latest leg higher.�� The softer print on your screen near 86,640 (platform quote) reflects intraday selling but is still consistent with a broader uptrend, meaning sentiment is “cooling, not collapsing.”��� USDINR is broadly stable around the 89.6 mark on some macro dashboards, signaling that FX volatility is not yet adding major stress to local equities or INR‑denominated crypto trades.��Trading ideas and key levelsFor Nifty intraday, support sits around 26,000–26,050, where buyers defended aggressively in recent sessions, while resistance is clustered near 26,250–26,320; a break on either side could set the tone for the rest of the week.�� On US30, the 47,000–47,200 band is emerging as a near‑term pivot; sustained closes below this zone would increase the odds of a deeper mean‑reversion towards medium‑term moving averages.�� Bitcoin traders can track the ₹78–80 lakh demand area as first support, with upside momentum likely to resume only if spot reclaims and holds above the recent swing band highlighted by local INR converters.�

Comments are closed.