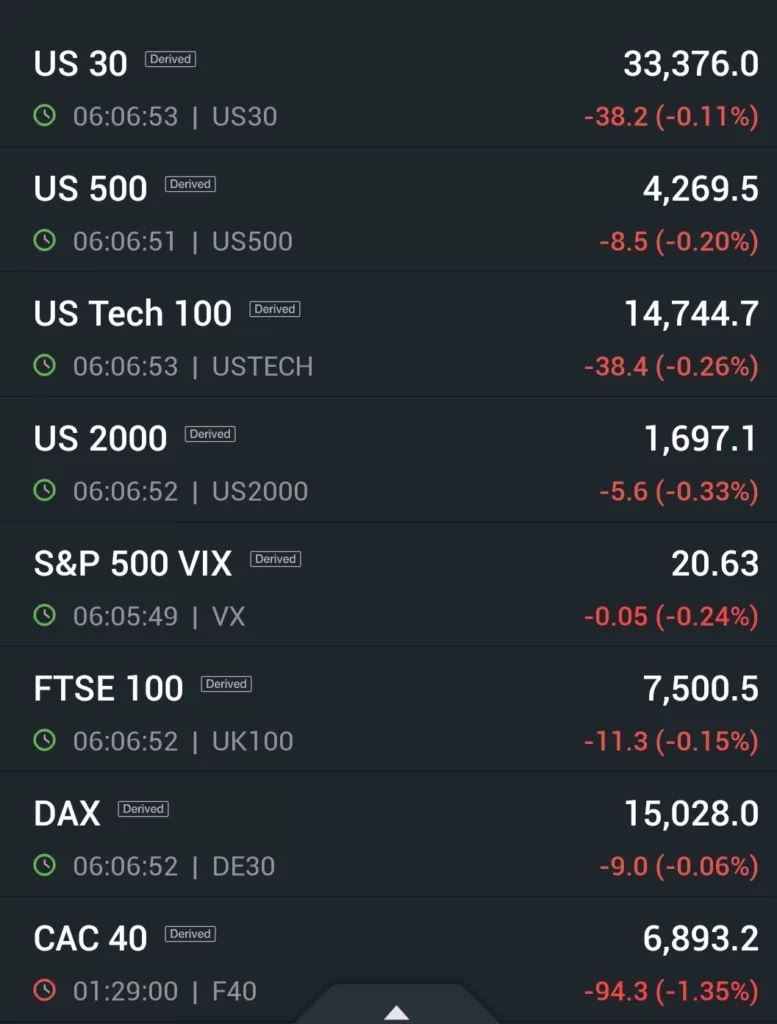

Global Markets Experience Decline, US Futures Show Signs of Weakness

In a turbulent day for financial markets, global stock indices are facing a notable decline, and the futures market in the United States is displaying early signs of weakness. This shift in market sentiment has left investors and analysts closely monitoring the situation.

Key Points:Global Market Slump: Stock markets across the world are witnessing a downward trend today. Factors contributing to this include concerns about economic growth, geopolitical tensions, and potential policy changes.US Futures: Futures contracts linked to major US indices, including the S&P 500, Dow Jones, and Nasdaq, are showing indications of opening lower. This suggests that investors are reacting to a combination of domestic and international issues.Geopolitical Uncertainty: Geopolitical events, such as international conflicts and trade disputes, can significantly impact global markets. Any escalations or resolutions in these matters can sway investor confidence.Economic Data: Economic indicators, such as employment figures, inflation rates, and consumer sentiment, can heavily influence market direction. Upcoming economic reports will be closely scrutinized for insights into the health of the economy.Investor Sentiment: Market sentiment is often guided by investor perceptions and reactions to news. Emotions can play a substantial role in short-term market movements.Long-Term Perspective: While short-term market fluctuations can be concerning, it’s crucial to remember that investing should be approached with a long-term perspective. Diversification and risk management strategies remain fundamental for investors.In conclusion, market volatility is a normal part of the investment landscape, and it’s important for investors to stay informed and make well-considered decisions. Watching for updates on both global events and economic data will be essential in navigating these turbulent times.

Comments are closed.