A Global Market Downturn

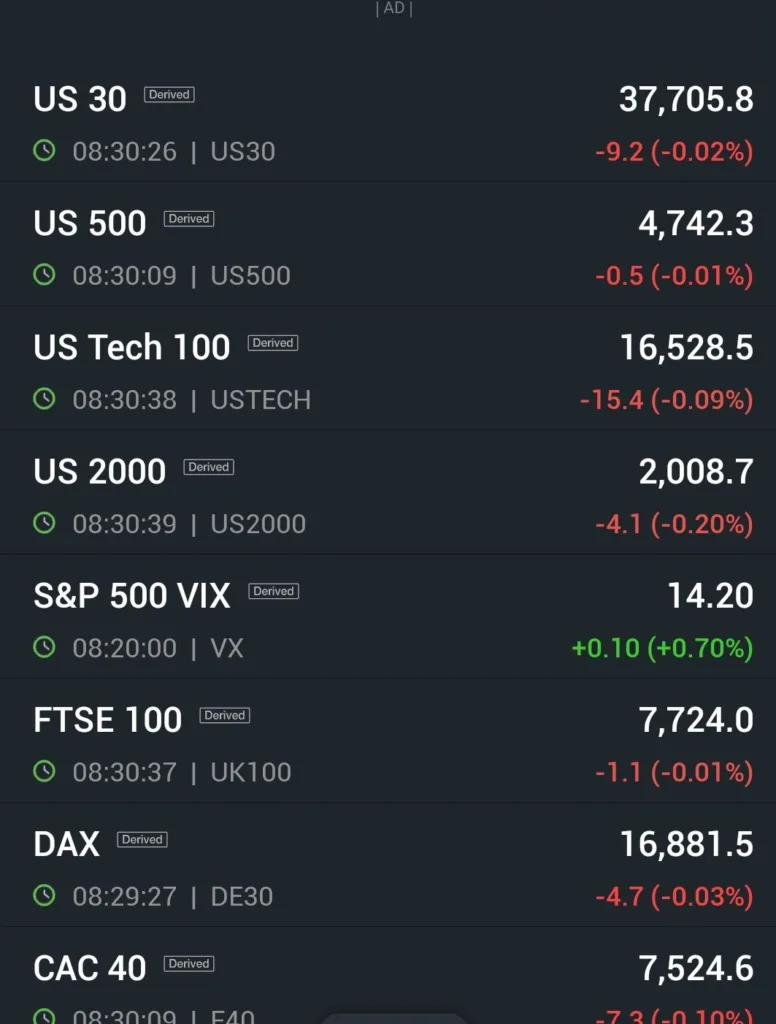

In the interconnected world of finance, the ripples of market fluctuations are felt across borders. Today, both the Asian and US markets find themselves in the red, and the Indian market is no exception. This blog post delves into the factors contributing to this synchronized downturn and explores potential implications for investors.

Body:

- Global Economic Concerns:

The synchronized decline in Asian and US markets suggests broader global economic concerns. Factors such as geopolitical tensions, trade uncertainties, and the impact of external events may be triggering a cautious sentiment among investors worldwide. - Tech Sector Volatility:

The tech sector, a significant player in both Asian and US markets, is experiencing heightened volatility. Supply chain disruptions, regulatory challenges, and shifts in consumer behavior are contributing to uncertainties that impact tech stocks, influencing market trends on a global scale. - Inflationary Pressures:

Rising inflationary pressures are a shared concern across economies. Central banks’ responses to inflation, such as adjusting interest rates, can have a cascading effect on financial markets. Investors are closely monitoring policy decisions and their potential impacts on market dynamics. - Pandemic Resurgence:

Lingering concerns about the COVID-19 pandemic, including the emergence of new variants, pose challenges to economic recovery. Markets are responsive to developments related to public health, impacting sectors such as travel, hospitality, and traditional retail. - Investor Sentiment and Risk Aversion:

Market sentiment is a powerful force. The current downturn may be fueled by a general sense of risk aversion among investors, leading to a shift towards safer assets. Understanding investor psychology is crucial in predicting market movements during times of uncertainty. - Indian Market Dynamics:

As part of the global landscape, the Indian market is not immune to external forces. Domestic factors, including economic indicators, corporate performance, and government policies, also contribute to the overall market scenario.

In the face of a synchronized global market downturn, investors must exercise caution and stay informed about the dynamic factors influencing market dynamics. Diversification, risk management, and a long-term perspective are essential in navigating the current financial landscape. As the world continues to grapple with economic challenges, adaptability and strategic decision-making will be key for investors seeking stability in turbulent times.

Comments are closed.